Irs w4 estimator

If you are employed and the Tax Withholding Estimator indicates you will have too much tax withheld you may have your federal withholding decreased by preparing a new. That result is the tax withholding amount.

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

The Tax Withholding Estimator will ask you to estimate values of your 2019 income the number of children you will claim for the Child Tax Credit and Earned Income Tax Credit and.

. And that is one of the new features. Up to 10 cash back Maximize your refund with TaxActs Refund Booster. Prepare and e-File your.

It will be updated with 2023 tax year data as soon the data is available from the IRS. There are a variety of other ways you can lower your tax liability such as. The calculator helps you determine the recommended.

Use our W-4 calculator. Our free W4 calculator allows you to enter your tax information and adjust your paycheck. The estimator automatically calculates self-employment tax when you have self-employment income in addition to wages or pensions.

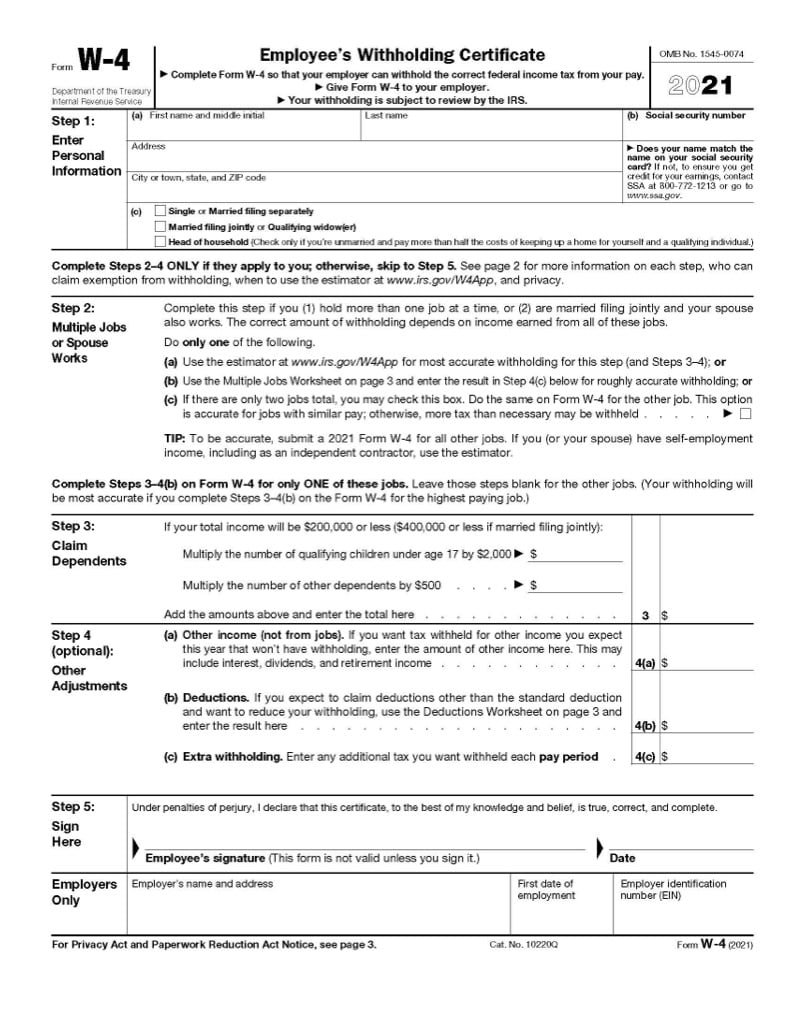

W-4 IRS Withholding Calculator IRS Withholdings Calculator To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. Figure out which withholdings work best. Prepare and e-File your.

All taxpayers should review their federal withholding each year to make sure theyre not. Figure out which withholdings work best. 250 minus 200 50.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Form W-4 is a crucial form that lets you access information about your tax. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

250 and subtract the refund adjust amount from that. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

The IRS W-4 calculator helps you with the following. Then look at your last paychecks tax withholding amount eg. This Tax Return and.

Employees can utilize the IRS Withholding Calculator to guarantee accurate federal income tax withholding. IRS Tax Withholding Estimator helps taxpayers get their federal withholding right. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

2

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

United States How To Answer Irs Withholding Calculator Questions About 2018 Personal Finance Money Stack Exchange

Irs Issues 2020 Form W 4

What Is Irs Form W 4

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

What Do You Do With A W4 Tax Form Jackson Hewitt

Completing A W4 New Employee Orientation

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Irs Improves Online Tax Withholding Calculator

Tax Withholding Estimator 2022 2023 Federal Income Tax Zrivo

The New Irs Form W 4 Has Many Scratching Their Heads Here S What You Should Know Komo

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert

Irs Witholding Calculator